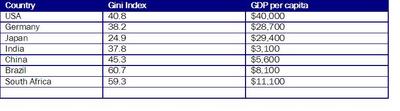

Chapter 4 : Enterprise Software for Emerging Economies Let’s have a look at a birds eye view of a few industries and how the local landscape impacts them in emerging economies. In this chapter we will zoom in on ERP, CRM, Healthcare and Retail industries. We will look at some of the critical factors that influence the product decisions in emerging markets for each of these industries. For starters let’s look at the following factors

- Infrastructure

- Often the biggest stumbling block for enterprise software companies. To be able to formulate a product strategy in any segment for an emerging market it is important to asses the infrastructural limitations of the specific country, its direction, role of the government, private sector investments or lack thereof etc.

- Regulations

- The power of public policy formulation in the technology sector can never be understated. The critical factor to consider here is whether the government is willing to let the private sector play a significant role in formulating the various policies associated with the emerging technology markets. For example, laws about Intellectual property rights, eCommerce trade laws, online privacy protection, telecommunication tariffs etc.

- Affordability

- In this book I have already discussed the concept of affordability in emerging markets several times already. In this chapter we look at it at a slightly angle. We will look at some of the factors that make it a relevant point of discussion. Enterprises are not very different from consumers when it comes to affordability as they work within similar constraints as the mainstream consumers. As we saw in the last chapter, the positioning of IT as a competitive differentiator has still to sink in emerging markets. Fundamental business issues like lack of scale and infrastructural challenges limit the effectiveness of IT in the enterprise setting. In this chapter we will look at a few industries and see how the affordability of technology might have an impact on product strategies

- Business practices

- Business practices of local economies can have profound impact on the software products. For example, the general inventory turnover requirements in china for American customers might be very different from those in Brazil for local customers. Similarly, Value added Tax calculations in most parts of the world are different with their own local variations. It is very difficult to asses and plan for such variations in business practices before designing the product for a specific geography.

ERP market in emerging economies – Focus country – China

Enterprise Resource Planning (ERP) is the evolution of early manufacturing applications into a full back-office solution including Financial, Human Resources, Manufacturing, Distribution, Customer Relationship Management and selected core vertical functionality.

ERP is the market for packaged applications, with an integrated user interface/code set-metadata/data set, that automate at least general accounting, inventory management, sales and/or purchase order processing, and some industry-specific business processes (e.g., materials requirement planning [MRP] in manufacturing, patient scheduling in healthcare delivery, or branch bank automation). Increasingly, ERP products also include many extended functions, such as treasury and profit management, human resources (HR) and workforce management, customer relationship management (CRM), intra- and interenterprise supply chain automation (SCA), and associated analytics. Although these extensions are not required in order to be considered ERP in this analysis, if they are integrated in the ERP product, the revenue is included in this measurement.

ERP applications are different from many other technology markets in that the business requirements drive the selection process. Hardware, operating system, database and other technology decisions are typically made in support of enterprise applications. There are three categories of business requirements:

- Horizontal – financials, HR, manufacturing, CRM, SCM, procurement, etc

- Vertical – Automotive, CPG, Financial Services, Oil & Gas, Telecom, etc.

Although the driving forces behind ERP implementations vary by vertical markets, the common theme across the various vertical markets are the inherent advantages of the ERP system. Most of the benefits gained from an ERP system are derived from improved back-office operations and the sharing of inventory among the business units. Other benefits include online and real-time information throughout all the functional areas of an organization, data standardization and accuracy across the enterprise, efficiency, and the analysis and reporting that can be used for long ERP planning. ERP comprises a commercial software package that promises seamless integration of all the information flowing through the company - financial, accounting, human resources, supply chain, and customer information.In addition, solid backbone ERP can allow companies to readily build their e-business capability for operations such as sales, procurement, and logistics, enabling tight integration between back-office processes and front-office transactions. Moreover, ERP systems provide transaction-level data that can be analyzed by predictive software solutions to optimize inventory management and enhance supply chain logistics. When predictive software is embedded in a real-time transaction stream, it can yield intelligence, enabling companies to adjust their business strategies.With its low labor costs and a vast domestic market, China is becoming the largest global manufacturing hub. However, local manufacturers are lagging far behind their global competitors in their IT infrastructure. In order to enhance their performance in the market, they actively adopted ERP applications during the recent years, which also drove the deployment of software in the manufacturing industry. This presents a tremendous opportunity for ERP vendors to capture this opportunity and ride the wave. The Chinese market for ERP applications was about $300 Million and is project to grow at more than 30% per year over the next 5 years. Here are some of the macro economic drivers that wield considerable influence over the manufacturing industry that in turn directly impacts the ERP market

- Government policies encouraged development of the ERP market.

- Government sponsored “863 Plan” defines an action plan fro identifying global trends in the IT industry. It is intended to create a favorable environment for the IT applications in the manufacturing sector. This induces planning for increasing the talent pool in the space of software, investment in key areas like automation of shop floor, agricultural IT sector etc. the China Software Industry Association ( CSIA ) issued a policy document called the “No 18 document” that promoted software industry in general. CSIA also sponsors sub committees on manufacturing software and to work on international standards bodies in this area

- The World Trade Organization (WTO) created more business opportunities.

- China's entry into the WTO has attracted a lot of Foreign Direct Investment ( FDI ) in the area of manufacturing. This has resulted in the integration of these manufacturing companies in the global supply chain. Overseas customers want to get real time information about production data to plan their supply chain effectively This has opened up a brand new opportunity for ERP applications

- Competitive landscape

- The ERP market world wide is dominated by large players like SAP, Oracle and Peoplesoft, etc. Local Chinese ERP vendors like UFSoft, Kingdee etc know the local market better and provide good customized software. Later in this section, we will explore the various attributes of this market closely .

- Role of channel partners

- ERP software is notorious for the complexities of the implementation cycle. Due to this, local channel partners are becoming increasingly important to vendors to increase efficiency and win bids. They are also pivotal in engaging with the customers and act as key relationship brokers between the global software companies and local customers. It is imperative to work with local Chinese Systems integration partners to have them aggressively sell and implement ERP products to local customers

- Small and medium sized business (SMB)

- Medium-sized and small customers are key drivers of consumption in China. Requirements for ERP products in this market segment are strikingly different from those in the enterprise segments in developed markets. Affordability, feature requirements, deployment, implementation are all quite different when it comes to small medium businesses. SMB customer budgets are typically lower, and delivery expectations considerably shorter, than those at the enterprise level. For this reason SMB customers cannot withstand long project implementation cycles and far-off returns on their investment. Their understanding of how technology can help their business is also much less sophisticated – many simply look to improve internal efficiencies through the automation of specific manual processes. SMB customers are typically not in the market for technology to drive competitive advantage, unlike their large enterprise counterparts. It is important in such an environment to provide a solution that can be implemented quickly with the least amount of integration cost, but that is robust enough to address more complex processes at a later date, if that time comes at all.

Product consideration for the Chinese market In this section, we will look at how to plan and develop ERP products to respond to the above challenges in the local market. We will apply the framework in chapter XX to think about the various local considerations and how it might impact the design of ERP products. Country analysis We discussed some macro economic numbers related to this earlier in this chapter and it is clear that China is rapidly shaping up to the manufacturing hub of the world. ERP software has traditionally followed manufacturing economies and this is going to be no exception. What is different in this case though is that more than 80% of the manufacturing companies in China are in the Small and medium business segment. This is a critical piece of information that needs to be factored in while designing ERP software for this market. Pricing strategies One of the stumbling blocks of ERP software acquisition is the huge upfront licensing costs. In this specific target market, companies should price it such that it becomes affordable to a large portion of the SMB market. Subscription based licensing, ROI based licensing and multi tiered SKUs at various price points are some of ways by which ERP can be made affordable to the SMB space. Partnering with local resellers who can customize the generic ERP product by incorporating local business logic like value added taxes can help in reducing the implementation time for these products. Unique business practices Most of the manufacturing is done for international customers in the developed world like western Europe or North America. This means that the ERP software needs to be flexible enough to provide the visibility into the inventory, production plans etc real time to the customers. This is often referred to as Supply Chain Visibility for it provides the customer visibility into all aspects of the supply chain. A more comprehensive view of the supply chain allows businesses to trim inventory, streamline logistics, and optimize the efficiency of their work forces as they gain a competitive advantage. Infrastructure Technology infrastructure could be a challenge in terms of predictable high speed internet connections in remote manufacturing areas. ERP software should be designed to support local caching of data that can synchronized with central data bases on a periodic basis depending on the availability of network bandwidth. Usability Another technical challenge could be that of archaic computers in these small manufacturing companies. ERP products designed for these markets should have very low memory footprint and should support multiple ways of user input like keyboard only. Multi device support for parts of the functionality like inventory stock taking should be allowed in the applications as it will allow for cheap hardware acquisition for menial tasks that really don’t need a computer. CRM market in emerging economies – Focus country – India CRM applications automate the sales, marketing, and services functions to provide a 360-degree view of the customer and enable enterprises to be more customer-focused. When CRM technology emerged about a decade ago, it was welcomed by businesses that were finding it increasingly complicated to maintain personal relationships with their customers. Early adopters started using the new technology primarily in the service and support departments to boost service quality and speed. As CRM vendors introduced more features and functionality, use of the technology spread across the enterprise, creating a whole new level of complexity. Companies started experiencing significant challenges, putting CRM into practice as the realities of conforming their business practices to what was technically feasible often overwhelmed more mundane issues like speed of deployment, user adoption, and basic functionality.As companies face the challenge of trying to extend business reach and at the same time curtail spending, CRM solutions are helping many customers get more out of their technology investments. However, whether starting from scratch or expanding an existing CRM implementation, understanding how CRM impacts ROI has become more critical than ever. Yet in order for CRM to continue to properly mature, metrics that conclusively prove CRM success or failure within enterprises must be developed and accepted. CRM software is predominantly used in the services businesses like call centers, consulting, telecommunications etc making it a very important software segment for a strong services economy like India. CRM software typically comprises of 3 distinct but interconnected parts

- Sales Force Automation ( SFA )

- SFA is typically used to manage sales opportunities and associated information like sale pipeline, opportunity management, scheduling, email etc. This is typically used my sales groups selling products or services

- Services Automation

- Services Automation is used to manage service and support requests from customers. Service request tracking, knowledge repositories, data mining, etc are all sub components of the Services automation software.

- Marketing Automation

- Marketing automation is used by marketing professionals to plan and run marketing campaign, collaborate with other marketing partners, marketing forecasting and analytics are all parts of a typical marketing automation system

Here are some key attributes to a generic CRM system: - Tracking customers efficiently is one of the main objectives of a CRM system. The application should be able to define and track customers. Customers need to be identified according to their importance based on the level of membership, investment, opportunities etc.

- CRM systems should be conducive to streamlining business development and marketing functions.

- CRM should enable cross-selling products and services across departments and divisions.

- CRM systems should be able to offer up information in various form factors and devices like smart phone and PDAs

- CRM systems often need offline functionality to support disconnected sales forces

- Leveraging knowledge bases and personal expertise in a collaborative manner is essential in providing timely accurate information to clients.

- Integrating with other legacy and back office systems to provide a full, 360° view of client relationships.

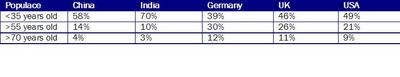

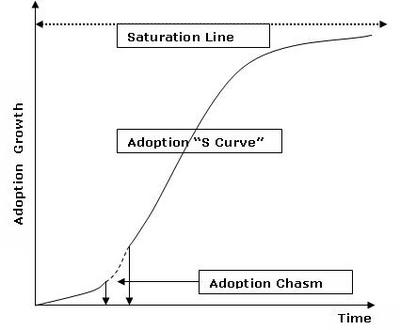

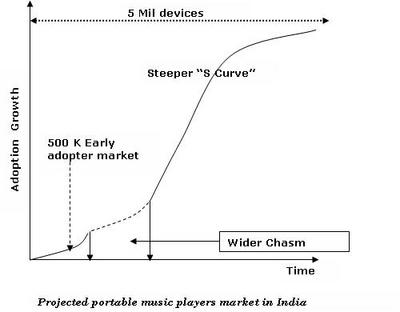

Key vertical markets in India for CRM applications Telecommunications: The telecommunication sector in India started opening up in the mid nineties and has not turned back since. This market is growing between 30-40% every year. The number of total wireless phones has overtaken the landlines and currently stands at about 50 Mil subscribers. In a country of 1.2 Bil people, this is less than 5% indicating a tremendous opportunity for growth in the next 5-10 years. The government has also been doing its part by reducing the various tariffs associated with this sector. This trend has been fundamentally responsible for energizing the domestic market for cell phone carriers and as a derivative, CRM software. Financial Services: The financial services market in India is one of the most mature markets in the emerging world. This market in India is booming as a result of key disinvestments in public sector involvement and subsequent opening up of the economy. Venture capital, investment banking, private equity and other financial institutions are struggling with ways to cut costs, increase efficiencies and manage prospect, client and consultant relationships while still developing and enhancing the overall sales process. They all need to track, manage and leverage all interactions with clients and prospects. Being able to leverage who in the firm knows whom, who knows what, and who knows how, can help uncover new business opportunities and enhance overall client service. To build this competitive advantage, firms must build their internal competitive intelligence and make this information available instantly to every professional. At most financial institutions, this intelligence is scattered throughout the organization making it virtually unusable. It may reside in the minds of firm professionals, in disparate databases or in countless contact managers. All these factors have the making of a perfect storm for strong CRM systems to help the companies meet the challenge. Product consideration for CRM in the Indian context In this section, we will look at how to plan and develop CRM products to respond to the above challenges in the local market. We will apply the framework in Chapter XX to think about the various local considerations and how it might impact the design of CRM products. The first aspect of the Lateral Design framework is to perform country analysis.Major trends in the Indian economy that impacts the CRM industry Outsourcing boom As China has become the manufacturing hub of the world, India has emerged as the Services hub of the world over the last 5 years. Most of these services operations that are being outsourced are customer facing and involves agents interfacing with consumers to capture their support requirements and subsequently up sell or cross sell other products and services that the company offers. For this to be executed efficiently, the companies need to have a strong understanding of the customer, their history, their preferences and their proclivity to buy more services. This is fuelling a strong growth in demand for CRM software in India. Booming domestic retail industry The middle class in India is an estimated 300 million people with a per capita income in the range of $3000-$6000 per annum. The recent opening up of the Indian economy has led to a gold rush of multinational consumer companies into India hoping to lure this burgeoning middle class. Consumer goods from air conditioning to mid sized cars to fast food chains have all started taking advantage of this market. The general optimism in the economy has also been successful in increasing the disposable income of the middle class contributing to the retail market in a big way. All this activity in the retail space has resulted in a flourishing service ecosystem around the global retailing companies making CRM software imperative to track and report on customer data. Local business practices Infrastructural challenges Sales automation is a big component of CRM software and its main target users are the sales professionals. They typically travel to customer locations to interact with them and to help win new business. The contact information, sales leads, opportunity lifecycle are all managed by the CRM system. To be effective, the sales professional has to enter data frequently ( ideally daily or at least weekly ) but in Indian conditions, internet connectivity in every city is not predictable. To accommodate for this, the software should support offline functionality so that the data could be entered locally and synchronized on a periodic basis. Infrastructural limitations - On demand CRM

- CRM Analytics requirements

Healthcare market in emerging economies – Focus country – South Africa Healthcare software industry can be classified into the following major areas

- Healthcare providers: This segment includes the following sub components:

- Inpatient: This is the largest segment in the Healthcare market and includes the medical equipment and the software that resides on it, hospital management software, software that allows physicians to collaborate with each other, patient management systems, etc.

- Physician offices: Software in this segment includes patient management, physician office management software that helps in scheduling and following up of patients in local clinics.

- Healthcare payer or Insurance: This sector is very large in the developed world where healthcare insurance is ubiquitous but not very big in the emerging world. This includes providers to payers integration software, patient billing applications, etc.

- Life Sciences: This segment deals with the disease research, drug discovery and biopharmaceuticals, bio informatics aiding in genome research etc.

Landscape of the healthcare system in South Africa South Africa's health system consists of a large public sector and a smaller but fast-growing private sector. Health care varies from the most basic primary health care, offered free by the state, to highly specialized hi-tech health services available in the private sector for those who can afford it. The public sector is under-resourced and over-used, while the mushrooming private sector, run largely on commercial lines, caters to middle- and high-income earners who tend to be members of medical schemes (18% of the population), and to foreigners looking for top-quality surgical procedures at relatively affordable prices. The private sector also attracts most of the country's health professionals. Although the state contributes about 40% of all expenditure on health, the public health sector is under pressure to deliver services to about 80% of the population. Despite this, most resources are concentrated in the private health sector, which sees to the health needs of the remaining 20% of the population. Widening gap between the public and private sectors Drug expenditure per person varies widely between the sectors. About R59.36 was spent on drugs per person in the state sector as opposed to R800.29 on drugs per person in the private sector. This gap is only widening further emphasizing the opportunity for healthcare software companies to focus on the private healthcare sector. Annually, the government spends the equivalent of approximately US$3.1 billion (at a late April 2002 exchange rate) on 35 million people, while the private sector spends US$36.5 billion on just seven million. The private sector, bristling with sophisticated technology, serves just 16% of the population – those with private health insurance. There are more than 200 private hospitals, owned by consortia of private physicians or large corporations. Private hospital beds number 24,537, public ones 110,143. Public healthcare is free to pregnant women and children under six; others pay on a means-tested, fee-for-service basis.The number of private hospitals and clinics continues to grow. Most new health professionals prefer to work in private hospitals and there has been a government program to bring doctors and other specialists from Cuba to serve the domestic market. With the public sector's shift in emphasis from acute to primary health care in recent years, private hospitals have begun to take over many tertiary and specialist health services. Public health consumes around 11% of the government's total budget, which is allocated and spent by the nine provinces. How these resources are allocated, and the standard of health care delivered, varies from province to province. With less resources and more poor people, cash-strapped provinces like the Eastern Cape face greater health challenges than wealthier provinces like Gauteng and the Western Cape. This presents a great opportunity for software providers to help optimize these processes and help the public and private sectors. The private sector in particular is very receptive to technological advancements in the healthcare industry thereby opening up the gates for healthcare software companies. CRM Heat Map Opportunities Countries Challenges  Product considerations for Healthcare softwareThe characteristics exhibited by South Africa are well representative of many major emerging markets. The overall healthcare spending in the emerging markets is about 5-7% of the GDP in these emerging countries while it is about 10-15% in the developed world. This is an amazing gap given the population and opportunities in raising the quality of living in these poor countries. The software industry is an unique position not only to capitalize on this growing trend but is also in a position to have a positive impact in the transformation of these societies and help them meet the challenges of basic healthcare. In this section we will focus on the specific segments in healthcare that can be leveraged by healthcare companies to gain entry into the emerging markets. Unlike the other sections, we will focus on the overall emerging market in general rather than just South Africa as many of the challenges in this market are transnational in nature. Hosted services Whenever software is discussed in the context of emerging markets, hosted software is immediately offered up as a solution to reduce costs. Unfortunately it is not that simple in most scenarios due to infrastructural challenges. Healthcare on the provider side is an area where hosted services do make sense to reduce cost for hospitals. Private hospitals usually have stronger infrastructure than local clinics and physician offices and can take advantage of hosted services. These hospitals seldom have IT professionals on staff and are a little resistant to managing software in house. Subscription based hosted services, where the business model lends itself to lower recurring payments also makes sense for this segment. The Life Sciences sector For our discussion, it s also very important to understand the life sciences sector as it has a profound impact in the emerging markets. The life sciences industry is best described as an ecosystem of science-oriented organizations consisting of several types of companies:· Pharmaceutical companies: organizations that discover, research, development, manufacture, and sell new medicines.· Biotechnology companies: smaller, specialty scientific organizations focused at discovery and development of treatments in specific therapeutic areas.· Medical device companies: organizations that discover, research, development, manufacture, and sell new medical instruments and devices.· Contract research organizations (CROs): business partners for pharmaceutical, biotechnology, and medical device companies that provide outsourced services for R&D, sales & marketing, manufacturing, laboratory sample analysis, and informatics.The life sciences industry represents a huge component of the global healthcare market. It currently represents a $330B market growing at 8% annually, and 15 of the world’s largest companies are life sciences firms. In this ecosystem, pharmaceutical firms are the largest customer organizations -- very large global operations with extensive scientific, operational, and partnership capabilities. Each of the top 10 pharmaceutical firms brings in over $10B in sales annually.Pharmaceutical FirmsGenerally speaking, most pharmaceutical firms consist of the following business areas:· Discovery and Preclinical: business units focused at identifying new target compounds for the treatment of specific disease states and markers. This work includes testing in vitro and in vivo.· Clinical development: business units focused at developing a new drug through scientific studies in humans, as well as the review and approval of the drug’s safety and efficacy by global regulatory authorities. This research is commonly called “clinical trials”, and moves progressively through various phases of research:o Phase 1: basic testing in healthy humans to profile the safety of a new drugo Phase 2 and Phase 3: broader testing in healthy and unhealthy humans to profile and safety and efficacy of a new drugo Phase 4 and Phase 5: longer-term studies, many conducted once the drug is commercially available, investigating the long-term effects of the drug on individual patients and patient populations.· Sales and Marketing : business units focused at promoting the value of specific drugs to physicians so that physicians will write prescriptions for the drug to their patient populations. In addition, pharmaceutical firms are increasingly marketing directly to consumers so consumers will exert influence on their physicians regarding particular drug treatments.· Manufacturing and Supply Chain : business units focused at creating drug products from raw materials, as well as distributing the drug products through sales distribution channels.· Finance and HR : the central business functions for pharmaceutical business operations· Information Technology: business units focused at technology used in central business functions as well as clinical and scientific functions.· Regulatory and Quality : business units focused at managing ongoing relationships with regulatory authorities, and ensuring that a pharmaceutical organization is compliant with applicable global regulations.For most organizations, the primary business driver is time-to-market for new medical treatments. Early in the R&D process, a pharmaceutical organization will file a patent on a new treatment that the company plans to develop into a commercial product (such as a new prescription drug). These patents have a fixed time duration before they expire -- once a patent expires for a given firm’s treatment, competitors are free to offer similar products at dramatically lower costs (commonly called “generic drugs”). Since the patent has to be filed before the company actually has completed the necessary research to bring the drug to market, the organization is driven to finish R&D as quickly as possible so as to maximize the amount of time that their product can be on the market without generic competitorRetail Software markets in Emerging MarketsPOS systems: Point of sale systems are the ones used in checkout counters for billing. They are typically embedded systems with bar scan software and help in keeping track of in store inventory. Retail POS systems are one of Retail back office systems: These are applications that Retail warehousing and logistics software

Product considerations for Healthcare softwareThe characteristics exhibited by South Africa are well representative of many major emerging markets. The overall healthcare spending in the emerging markets is about 5-7% of the GDP in these emerging countries while it is about 10-15% in the developed world. This is an amazing gap given the population and opportunities in raising the quality of living in these poor countries. The software industry is an unique position not only to capitalize on this growing trend but is also in a position to have a positive impact in the transformation of these societies and help them meet the challenges of basic healthcare. In this section we will focus on the specific segments in healthcare that can be leveraged by healthcare companies to gain entry into the emerging markets. Unlike the other sections, we will focus on the overall emerging market in general rather than just South Africa as many of the challenges in this market are transnational in nature. Hosted services Whenever software is discussed in the context of emerging markets, hosted software is immediately offered up as a solution to reduce costs. Unfortunately it is not that simple in most scenarios due to infrastructural challenges. Healthcare on the provider side is an area where hosted services do make sense to reduce cost for hospitals. Private hospitals usually have stronger infrastructure than local clinics and physician offices and can take advantage of hosted services. These hospitals seldom have IT professionals on staff and are a little resistant to managing software in house. Subscription based hosted services, where the business model lends itself to lower recurring payments also makes sense for this segment. The Life Sciences sector For our discussion, it s also very important to understand the life sciences sector as it has a profound impact in the emerging markets. The life sciences industry is best described as an ecosystem of science-oriented organizations consisting of several types of companies:· Pharmaceutical companies: organizations that discover, research, development, manufacture, and sell new medicines.· Biotechnology companies: smaller, specialty scientific organizations focused at discovery and development of treatments in specific therapeutic areas.· Medical device companies: organizations that discover, research, development, manufacture, and sell new medical instruments and devices.· Contract research organizations (CROs): business partners for pharmaceutical, biotechnology, and medical device companies that provide outsourced services for R&D, sales & marketing, manufacturing, laboratory sample analysis, and informatics.The life sciences industry represents a huge component of the global healthcare market. It currently represents a $330B market growing at 8% annually, and 15 of the world’s largest companies are life sciences firms. In this ecosystem, pharmaceutical firms are the largest customer organizations -- very large global operations with extensive scientific, operational, and partnership capabilities. Each of the top 10 pharmaceutical firms brings in over $10B in sales annually.Pharmaceutical FirmsGenerally speaking, most pharmaceutical firms consist of the following business areas:· Discovery and Preclinical: business units focused at identifying new target compounds for the treatment of specific disease states and markers. This work includes testing in vitro and in vivo.· Clinical development: business units focused at developing a new drug through scientific studies in humans, as well as the review and approval of the drug’s safety and efficacy by global regulatory authorities. This research is commonly called “clinical trials”, and moves progressively through various phases of research:o Phase 1: basic testing in healthy humans to profile the safety of a new drugo Phase 2 and Phase 3: broader testing in healthy and unhealthy humans to profile and safety and efficacy of a new drugo Phase 4 and Phase 5: longer-term studies, many conducted once the drug is commercially available, investigating the long-term effects of the drug on individual patients and patient populations.· Sales and Marketing : business units focused at promoting the value of specific drugs to physicians so that physicians will write prescriptions for the drug to their patient populations. In addition, pharmaceutical firms are increasingly marketing directly to consumers so consumers will exert influence on their physicians regarding particular drug treatments.· Manufacturing and Supply Chain : business units focused at creating drug products from raw materials, as well as distributing the drug products through sales distribution channels.· Finance and HR : the central business functions for pharmaceutical business operations· Information Technology: business units focused at technology used in central business functions as well as clinical and scientific functions.· Regulatory and Quality : business units focused at managing ongoing relationships with regulatory authorities, and ensuring that a pharmaceutical organization is compliant with applicable global regulations.For most organizations, the primary business driver is time-to-market for new medical treatments. Early in the R&D process, a pharmaceutical organization will file a patent on a new treatment that the company plans to develop into a commercial product (such as a new prescription drug). These patents have a fixed time duration before they expire -- once a patent expires for a given firm’s treatment, competitors are free to offer similar products at dramatically lower costs (commonly called “generic drugs”). Since the patent has to be filed before the company actually has completed the necessary research to bring the drug to market, the organization is driven to finish R&D as quickly as possible so as to maximize the amount of time that their product can be on the market without generic competitorRetail Software markets in Emerging MarketsPOS systems: Point of sale systems are the ones used in checkout counters for billing. They are typically embedded systems with bar scan software and help in keeping track of in store inventory. Retail POS systems are one of Retail back office systems: These are applications that Retail warehousing and logistics software