Chapter 5: The Consumer Market

Chapter 5: The Consumer Market

Introduction

When transcending national borders, products have to go through a top down cleansing. Marketers and product developers in almost any industry face a multitude of challenges in getting their respective products ready for global markets. Consumer software is more difficult to localize, to launch and to strike a chord with the local people than enterprise software. It is not unlike in other industries where the products that are more intrinsically linked to the lifestyle like food, drinks, cars etc are inherently more difficult to customize than say, engine oils , razor blades or jeans.

The first reason for this is related to the fit of the product in the target consumer’s life style. An excellent example is breakfast cereal that is popular in most western economies but has little resonance with eastern consumers as it is quite a departure from their traditional diet. Another example is instant coffee which is quite popular in Britain an Ireland but is not so in Germany and France where the consumers prefer freshly brewed coffee over the instant variety.

The second reason for this phenomenon is directly related to newness of the product. Newer classes of products like computers, mobile phones etc have a better chance of faster global acceptance than food products that are well entrenched in the culture.

I would argue that software especially the ones that are intended for the consumers fall into the first category. Software like the ones that keep personal appointments, communication – email, instant messages, SMS etc, authoring, gaming etc are all tied intrinsically to the lifestyle of people and could be tied back to the socio economic attributes that influence a certain set of people.

“Socio”, because cultural and generational influences have distinct impact on the usage of consumer software. For example,

“Economic” because affordability and credit factors have distinct impact on adoption of new software and associated products.

Some macroeconomics

Before going any further into specific genre of consumer software products or exploring a few strategies in the emerging market consumer space, let’s get a few basic macro economic definitions out of the way. Though this book is not a treatise on macros economics, it is important to appreciate a few key points in order to formulate strategies for this segment.

Gini Index:

While formulating business models and pricing strategies in the consumer market, it is important to understand the factors that influence buying behavior. GINI index or GINI coefficient is perhaps the least celebrated of the macro economic indexes but is a great indicator of the consumer buying patterns. It is usually used to measure income inequality, but can be used to measure any form of uneven distribution. The Gini coefficient is a number between 0 and 1, where 0 corresponds with perfect equality (where everyone has the same income) and 1 corresponds with perfect inequality (where one person has all the income, and everyone else has zero income). The Gini index is the Gini coefficient expressed in percentage form, and is equal to the Gini coefficient multiplied by 100. The Gini coefficient's main advantage is that it is a measure of inequality, not a measure of average income or some other variable which is unrepresentative of most of the population, such as gross domestic product.

GDP statistics are often criticized as they do not represent changes for the whole population, the Gini coefficient demonstrates how income has changed for poor and rich. If the Gini coefficient is rising as well as GDP, poverty may not be improving for the vast majority of the population. The Gini coefficient can be used to indicate how the distribution of income has changed within a country over a period of time, thus it is possible to see if inequality is increasing or decreasing.

This measure is key for several reasons. When we talk about consumer products including consumer software, we are essentially talking about volume. To size the market accurately and prepare product and services offerings for the appropriate micro segments, a GINI Index based segmentation is essential. Some countries have such varying degrees of inequalities that it is impossible to create a mass market product since it implies a staggered income distribution.

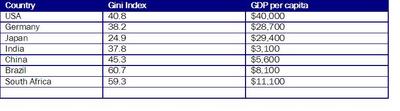

Here are some examples of countries along with their GINI indices

Source: United Nations – Human Development Report 2004, CIA World Fact book 2004

Analysis

- Japan with a low Gini index and a very high per capita GDP indicates a very rich country that has a fairly uniform distribution of wealth. This combination speaks volumes about the affordability of the general population. This is very well backed up by real consumer data that shows strong propensity for personal electronics spending on goods like camera, mobile phones, gaming stations, music and entertainment gadgets etc.

- India with a relatively low Gini Index along with a low national GDP indicates that even though the country is poor, the spread is relatively very narrow making it a very attractive consumer market. This is of course contingent on the right strategy with regards to pricing , perceived value of the service, etc.

- China on the other hand tells a different story with its high GINI index for its low per capital income indicates a dispersion in the market making it a little more complicated than Indian when it comes to formulating segmentation and pricing strategies.

- Brazil and South Africa indicate rare high levels of GINI indices implying an uneven distribution of wealth in these countries. This is also a fairly common trend in many other South American and African counties as well.

PPP

Purchasing Power Parity (PPP) is a method used to calculate an alternative exchange rate between the currencies of two countries. The PPP measures how much a currency can buy in terms of an international measure (usually dollars), since goods and services have different prices in some countries than in others.

PPP exchange rates are used in international comparisons of standard of living . A country's GDP is originally tallied in its local currency, so any comparison between two countries requires converting currency. Comparisons using real exchange rates are considered unrealistic, since they do not reflect price differences between the countries. The differences between PPP and real exchange rates can be significant. For example, GDP per capita in Mexico is ca. 6,100 U.S. Dollars , while on a PPP basis, it is 9,000$ (U.S. GDP/capita is 37,388$, as of 2004 ).

First suppose that one U.S. Dollar (USD) is currently selling for ten Mexican Pesos (MXN) on the exchange rate market. In the United States wooden baseball bats sell for $40 while in Mexico they sell for 150 pesos. Since 1 USD = 10 MXN, then the bat costs $40 USD if we buy it in the U.S. but only 15 USD if we buy it in Mexico. Clearly there’s an advantage to buying the bat in Mexico, so consumers are much better off going to Mexico to buy their bats. If consumers decide to do this, we should expect to see three things happen:

- American consumers desire Mexico Pesos in order to buy baseball bats in Mexico. So they go to an exchange rate office and sell their American Dollars and buy Mexican Pesos.

- The demand for baseball bats sold in the United States decreases, so the price American retailers charge goes down.

- The demand for baseball bats sold in Mexico increases, so the price Mexican retailers charge goes up.

Purchasing-power parity theory tells us that price differentials between countries are not sustainable in the long run as market forces will equalize prices between countries and change exchange rates in doing so.

Other macro economic measures that influence

Disposable income

Urban Vs Rural population dispersion

Rapid urbanization of the world has been a well documented topic over the recent years and a close look at the statistics reveal enlightening views. China and India still have a predominantly rural ( 70% ) population. Brazil and Argentina on the other hand have about 80-90% of the population residing in large urban cities. This dispersion is important for consumer markets as rural consumers are traditionally harder to reach and severe infrastructural limitations hamper rapid deployment and adoption of new technologies and products.

Population age dispersion

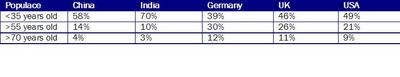

It is essential to understand the distribution of population in the various economies as it speaks volumes about the trends in consumer spending and the types of software that are likely to be used. Lets’ take a minute to glance through the date

Source: United Nations Demographics report:2002

The above data clearly indicates several things. In a nut shell, we can summarize that China and India have younger populations than the developed economies like Germany, UK and USA. 70% of India’s population is less than 35 years old indicating a massive ( more than 700 Mil ) market of young, earning people who probably also have a higher portion of disposable income than people that are older than say 55 years.

Consumer software companies have to pay close attention to the above trends as many of the genres of consumer software like entertainment, communication etc are more appealing to the <35 years segment.

Now that we have taken a whirlwind tour of macro economics, lets turn our attention to the various markets that make up the consumer software market. It will not be a stretch to say that the consumer software market is no where as mature as the enterprise segment. Although software has touched out lives in a significant way since the internet boom in the mid 90’s it is still nearly not as influential as it has the potential to become. Software companies have also focused almost exclusively on the enterprise segment as the demand and predictability of this market is far more stable and consistent than that of the consumer segment. This combined with the fact that consumer markets vary far more across cultural and geographic boundaries make it more complex to cross market products that have been developed to cater to a specific market.

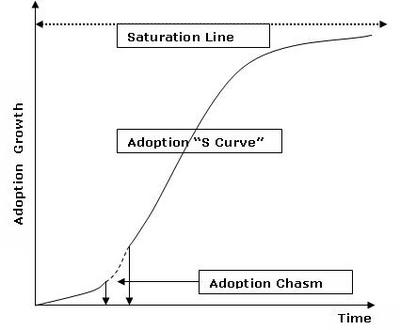

Adoption characteristics - S Curve

The tradition S Curve is a great tool for analyzing how consumers adopt new technologies. The S Curve deals with the cumulative adoption of any new product or technology by the mass population. It starts off with a steep incline that indicates rapid adoption of the new technology by a very small segment of the population followed by a steady curve where most adoption takes place. WE can characterize this part of the curve as the “mainstream adoption”. The curve flattens once we reach towards the top of the chart and the ceiling indicates the saturation line for the particular product. For ex, take online gaming for example- there is only a sub section of the population that is interested in the online gaming market and it is usually a predictable steady line that is constant along time. The rate of adoption of new products like xbox might vary due to numerous other factors but it will be considerably shorter and steeper than the original gaming curve of the 80s as the awareness of computer games has increased tremendously over the last two decades. The same argument can be extrapolated to other technologies like mobility software, DVD players etc.

In his book “Crossing the Chasm”, Geoffrey Moore talks about the chasm that exists between adoption of new technologies by the enthusiast and visionaries and the main stream population.

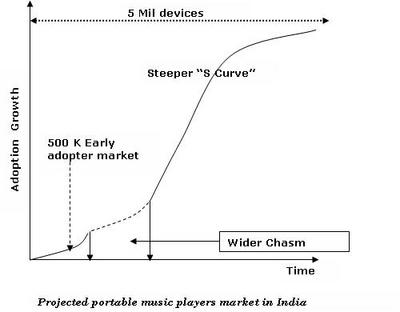

S Curve variations in Emerging economies

This chasm could be small and short lived and in some other cases like the emerging economies, it is deeper and longer. I draw this inference based on the analysis of income distribution we did in the last section using the GINI index. Lets try to plot the same curve for an emerging economy. In developed economies, the chasm is more a result of technological apprehensions than it is due to the economic dispersion. In emerging economies on the other hand, the chasm is an absolute product of wildly varying economic dispersions. For example, take mobile music devices like iPod or other music players. Lets say, of the 700 Mil people in India below the age of 35, 20% ( about 140 Mil) would like to listen to some kind of music during their normal day of activity. Of this 140 Million only about 5 million ( 3.5%) will be able to afford the devices. Once we have eliminated the first barrier to entry, lets see how the S Curve fits into this target segment. In most markets, the Early adopters to the left of the chasm is only about 10% of the mainstream audience putting our number at about 500, 000 likely early adopters which is not a bad number considering the product. The main challenge for any new product entering a virgin market is to cross the chasm and move to the mainstream where 905 of the target market resides.

Other observations

- The depth and the width of the chasm is directly proportional to the GINI index. Higher GINI numbers indicate a wider dispersion of wealth among the population and hence the longer it would take to bridge the gap between the wealthy early adopters and the mainstream adopters.

- The general steepness of the curve is a factor of per capita GDP and disposable income. The more the disposable income is, the steeper is the curve for non essential products like mobile audio players.

Market segments

In this section, we will look at the overall landscape of the consumer market segment and how the various concepts we explored in the first part of this chapter can be applied to the overall landscape. Consumer software markets can be generally classified into the following categories:

Personal productivity

Consumer software owes its origins to this segment with the original word processing tools like Lotus 1-2-3 and Word Perfect, etc. Remarkably, this segment has been devoid of much innovation despite advancements in graphics, internet, hardware, form factors etc. I would argue that personal productivity software is no where close to influencing our daily lives as much as it can potentially be. Here are some examples of personal productivity applications that have evolved over the years.

Desktop applications

Desktop operating systems can also be considered a part of this segment for a lack of better alternative. Other applications such as browsers, music players, photo organizers etc are all part of this genre as well. Communication and organizational tools such as Email, web conferencing tools, appointments also fall into this category.

EM considerations:

In emerging markets the above category of applications form the baseline of desktop computing. The main obstacle to mainstream adoption of personal computers has been the high barrier to entry of acquisition costs associated with the purchase. This can be mitigated to a large extent by innovating on payment models as I have touched upon several times in this book. Smart packaging by the hardware and software vendors can substantially reduce the price of acquisition. For example consider this scenario- The cost of a new branded desktop PC is about $500 in most emerging markets. In pure economic terms, it is about 10% of the per capita GDP for a country like India. Comparatively, the cost of a new PC in the untied States is only about $1000 which is about 2.5% of the per capita income. This significant variation is the most obvious barrier to entry for desktop PCs. One way of solving this is to subsidize the procurement by forming a bundle of the hardware, the operating system and compelling desktop applications like personal finance, communication and gaming software. The users could then be charged the same $500 over a period of 12 or 18 months through a reliable channel like the television cable company or the phone provider. I like to call this model “Subscribe to own” where the user will own the rights to the software and hardware when they pay off the total amount. Along with innovating on the payments side, the software should also be customized and localized for local languages and cultural aspects. We will look into this more in the subsequent sections

Entertainment software

This category has more cultural overtures than any other class of consumer applications. I don’t have the data but having lived in emerging economies, I can attest to the fact that people in emerging countries spend quite a bit of their disposable income in personal entertainment like movies, music, games etc. The software industry as a whole has really not made a lot of inroads into this segment.

EM considerations:

We have to think about ways by which software can enrich and at the same time piggy back on the enormous popularity of local movies and music.

Interactive TV

TV penetration in Emerging markets is usually at astronomical levels. This market is ripe to be taken advantage of by offering value added services to basic television. As with the mobile phone platform, value added services can be built into the delivery channel. This has huge advantages like eliminating the requirement for a separate billing solution which is a major stumbling block in emerging economies. Television is one of the most accepted appliances in this market and has already reached critical mass in terms of acceptance and penetration. Value added services like programming on demand, educational programs, provisions for buying merchandise etc can all be considered. Most of these services can also be provided without having to change the television set and can be accomplished with the installation of a set top box. With embedded software in these set top boxes, software companies can also experiment with personalization, child locks, programmability etc.

New software delivery models

Gaming

Mobility

- Cell Phone software

This is classic B2C market that led the dotcom boom of the late 90’s. This fad never really reached the Emerging Economies before bursting in 1999. Though this segment has mellowed down since its early peak days, it still holds a lot of promise. It will have to slowly overcome many challenges in the emerging markets like lack of established and trustworthy online credit payment vehicles, lack of organized supply chain etc. Let’s first look at this segment a little closely before diving into the challenges associated with this market.

Auctions

eBay is one of the few companies that survived the onslaught

- Sharing and collaboration ( pictures, files music etc )

- Travel

- Other misc ecommerce

Music industry

Music - online or not, is a talent-based industry. Developed countries used to have advantages in technology, but the general progress in computing and the Internet is rapidly eliminating any difference. The low overhead associated with production and consumption of music makes it very attractive for emerging markets as a viable medium of digital entertainment.

In emerging markets, music reproduction is a critical part of the socio economic make up. In most of the cases, this reproduction has been through illegal ways. The global entertainment sector has recently been more concerned about restricting illicit use of copyrighted content, and thus may provide only marginally relevant guidance for artists and industry in developing countries.

As I explained earlier in this chapter, emerging economies spend an inordinate amount of money on music and entertainment.

Education

Emerging economies place a premium on education and this can be used a vehicle for reaching out the consumers in these markets. Education for consumers can be classified along the same lines as those in traditional markets but for the purpose of our discussion in this context, lets stick with the segment of higher education. The reason I want to narrow the discussion down is because of the fact that this is the most likely segment to spend money on software for educational purposes. Higher education is typically pursued by the middle class who will benefit from this offering.

Online higher education, which involves the dissemination of, access to, and exploitation of

higher education, including research, via the Internet, is being explored and promoted as a strategy

to provide further access to education and technology for national and international students. For example, in India students are able to obtain via the Internet a bachelor’s degree in information technology (IT) from the Indira Gandhi Open University (IGNOU). IGNOU is building on its existing structure as a distance education provider. The current online higher education market is still small (compared with traditional face-to-face education) and fragmented (with multiple providers

and self-developers providing flexibility, innovation and plurality but also some confusion). Online programs are concentrated in the most popular and marketable subject areas ( business management, technology , and education)

Barriers to consumer software adoption in emerging economies

Affordability

As we have seen in a couple of different places in this chapter and the book, affordability is a key recurring theme in the emerging economies for influencing adoption of any kind.

Infrastructure

Infrastructural limitations in emerging countries have severe repercussions in the adoption curve as well as the depth of adoption.

Half Life of technologies

Emerging economies don’t have the luxury to experiment on emerging technologies. Neither do they have the critical mass of early adopters to push the volume nor do they have the infrastructural set required to respond to constantly changing landscape. For example, lets look at large scale public deployment of public WiFi networks.

How have the emerging countries been solving some of the above mentioned issues and how can software companies act as catalysts to influence and accelerate this ? This will be the main theme of this section.

Technology case study : mobility space in Asia

Summary:

The Asian mobile data market was more than $25 billion with a revenue growth rate of close to 30%. There is a pronounced shift from voice to data traffic in this market which in turn allows for a multitude of new rich services delivered by software to enrich the user experience. Increasing demand has arisen for more data based applications in both the business and consumer sectors.

Systematic and almost complete deregulation of the Asian telecommunication industry speeded up these significant changes earlier in the decade. Consumers have opened up to the notion of having most of their communication happen through tiny mobile phones and this is fast challenging the value and acceptability of bulky desktops and PC based devices.

The fascination around mobile data services is not isolated to Asia but it would be safe to say that it has caught its imagination more than in any other part of the world. Some estimates indicate that around 25% of disposable income for the youth is spent on mobile products in these markets, displacing spending on traditional youth products like clothing, books, sporting equipment etc.

The youth plays the most important role in shaping up this market. Key software scenarios include messaging, ring-tones, wallpapers, logos, games, music and videos, and others.

Messaging services and other variations of SMS continue to remain the most popular service in the youth market. It is as much a lifestyle issue as much as it is a technology. Revenue generated from SMS has a growth rate of more than 30% with value added services like weather, sports scores, news etc make up this hot growth market.

Other segments of growth

Mobile Gaming

Mobile gaming is fast emerging as the favorite application for young mobile users across the world, spearheaded by Japan and South Korea where content has grown in terms of technology sophistication. Service providers are turning to mobile games to drive the demand for 3G services alongside the growing need for high-speed data transmission. The mobile games market in the Asia Pacific region is estimated at $1.4 billion in 2004. This industry is set to more than triple its size by 2010. The deployment of 3 G network infrastructure in some of these geographies will be a major boost to get the aggressive adoption rates even higher. This segment holds great promise and the deployment of next-generation technologies herald the new beginnings of rich mobile content development such as video clip download and streaming, music broadcasting and music album in the tier 1 markets.

This is a great opportunity for software companies to leverage their experience in the development of software and animation into the mobile world. Mobile games have evolved from basic monochrome single player games to full fidelity multiplayer, GPS-based games.

Payment models

Pay for bandwidth Paying for usage is probably the most time tested of all models. Per-kilobyte charge model is a volume–based model charged by the operators. NTT DoCoMo’s i-mode mobile Internet services have been offered primarily using this payment model. Mobile content like music and video are available from tailored i-mode handsets. The option of per kilobyte is commonly available with different rates varied across the countries.

Pay for usage

Usage based payment models normally works on commoditized content like ring-tones, pictures, music, etc; where no monthly fee is required and users are only charged for the number of downloads per content type. Software companies should look at this model more closely as it embodies the micro credit model that is absolutely required for reaching out to the masses.

Unlimited

True to its name, the unlimited model indicates a flat monthly charge billed to the subscriber with unlimited usage. Though it is one of the most complete models, it is typically associated with higher costs.

1 Comments:

Having said that, lets explore the possibility of Web Conferecing. This unique system allows users to communicate with each no matter where the individuals are located. With the addition of a microphone and web cam we can communicate via the web. Personally I have found that this is your best avenue to reducing time spent traveling to see your clients. Saving money is another reason for using IConference.

Post a Comment

<< Home